Wellington Rental Market Review October 2025

The Wellington Rental market continues to feel the pressure with the imbalance of supply and demand still a major factor for both landlords and tenants to consider. Whilst the available stock of rental properties advertised have dropped from a high of over 1,700 in June this year, the current supply level sits at around 1,300 or so – still much higher than the norm of around 1,000 at most during this time of year.

This has meant pressure on rents in the area have remained and have impacted the median rent data for the region which has come down to $595 per week as of August 2025 – down 8.5% year on year according to TradeMe’s latest Rental Price Index.

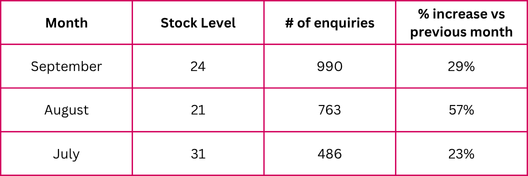

In recent weeks we have noticed a slight uptick in demand, and the team have a packed month of commencing tenancies with seventeen due to start in October already. Enquiry levels on our available stock has risen sharply in the last few months as we come out of the typically slow winter season:

Notably, some newly advertised stock is starting to generate double digit enquiries within a few days. The key traits for this success are definitely getting the right level of pricing combined with a good marketing strategy including professional photos, floor plans and even staging where possible.

The average days on market according to RealEstate.co.nz Insights are roughly an average of around 31 days for the Wellington area. This does not however take into account wait times for new tenancies to commence once the property has been withdrawn from advertising and its not uncommon for us to be seeing vacancy periods still of anywhere between 2-4 weeks or more.

Tenants still have plenty of choice in the market and are definitely shopping around at tenancy renewal time. Renewing tenants are also requesting rent deductions as an incentive to sign onto a new tenancy, and there are still plenty of incentives being advertised to try and encourage enquiries on available stock as identified in this recent Stuff Article.

If you would like any further information or insights into what we are seeing on the front line of the industry please don’t hesitate to contact us.